Get the free hra 121 form

Show details

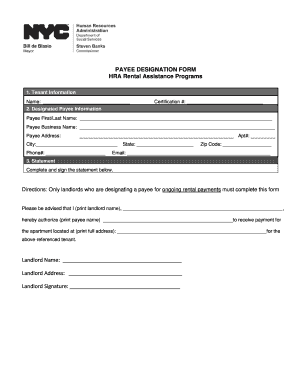

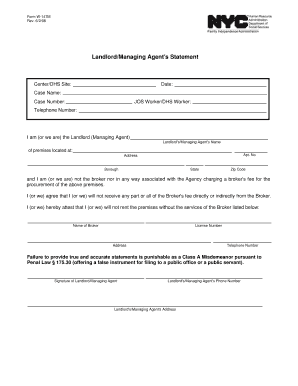

HRA-121 (E) 07/24/2015 Date: Tenant s Name: Lease ID # (if applicable): Telephone Number: Broker s Request for Enhanced Fee Payment by Check HRA will issue a check for a broker's fee for households

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your hra 121 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hra 121 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hra 121 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit hra 121 fprm form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

How to fill out hra 121 form

01

To fill out HRA 121, you will need to gather all necessary information and documents. This includes personal details such as your name, address, and contact information.

02

Next, you will need to provide information about your household. This includes the number of people living in your household and their relationship to you. You may also need to provide details about any dependents you have.

03

You will then need to provide information about your income. This includes documenting any sources of income you have, such as wages, self-employment income, or income from investments. You may also need to provide proof of income, such as pay stubs or bank statements.

04

Additionally, you may need to provide information about your housing situation. This could include details about your current living arrangements, such as whether you rent or own your home, the monthly rent or mortgage payment, and any utilities or expenses related to your housing.

05

Finally, you will need to submit the completed HRA 121 form to the appropriate government agency. This may vary depending on your location, so be sure to follow the instructions provided on the form or contact your local government office for guidance.

Who needs HRA 121:

01

HRA 121 is typically required by individuals or households who are seeking government assistance or benefits related to housing. This could include programs such as rental assistance or subsidized housing.

02

It may also be required for individuals who are applying for certain types of loans or financial assistance that are tied to housing or living expenses.

03

Additionally, some employers or organizations may require employees or members to fill out HRA 121 forms for internal purposes, such as determining eligibility for housing-related benefits or allowances.

In summary, filling out HRA 121 involves gathering necessary information, providing details about your household and income, documenting your housing situation, and submitting the completed form to the appropriate agency. It is typically required by individuals or households seeking housing-related assistance or benefits.

Fill brokers request for enhanced fee payment check where to email : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is hra 121?

HRA 121 could refer to a variety of things, as the term has multiple meanings in different contexts. It is important to provide more information or context to accurately determine what exactly HRA 121 refers to.

Who is required to file hra 121?

HRA 121 refers to the Home Renovation Allowance available in Ireland, which is a tax relief scheme for homeowners who carry out renovation or improvement works on their main home.

In order to be eligible to apply for HRA 121, the following requirements must be met:

1. You must be an owner-occupier of the property.

2. The property must be your main residence.

3. The property must be at least 15 years old.

4. The works must be carried out by a qualifying contractor.

5. The cost of the works must be a minimum of €4,405 (excluding VAT).

6. The cost of the works must be a maximum of €30,000 (excluding VAT).

Therefore, homeowners who meet these criteria are required to file for HRA 121 if they want to avail of the tax relief. It is important to note that this information is specific to Ireland, and tax laws and requirements may vary in different countries. It is recommended to consult with a tax professional or the relevant tax authority for accurate and up-to-date information regarding filing requirements for HRA or similar schemes in your jurisdiction.

How to fill out hra 121?

To fill out HRA 121, follow these steps:

1. Start by downloading the HRA 121 form from the official website of the relevant authority or agency. Make sure you are using the latest version of the form.

2. Begin by providing your personal information in the appropriate sections. This typically includes your full name, address, contact information, social security number, and date of birth.

3. Fill out the section regarding the specific benefits or programs you are applying for with the HRA. Provide accurate and detailed information to ensure the proper processing of your application.

4. If you are applying for benefits on behalf of someone else, such as a child or dependent, indicate their information in the appropriate section.

5. If necessary, provide information about any other benefits or assistance you are currently receiving or have applied for.

6. In the employment section, provide details about your current employment status and any income you receive. This may include your employer's name, address, contact information, and details about your income.

7. Fill out the section regarding your combined income. Provide accurate information about all sources of income, including wages, self-employment income, rental income, and any other applicable sources.

8. If you have any assets, such as property or savings, provide the requested information in the appropriate section.

9. Sign and date the form. Ensure that you have completed all the necessary sections and that the information provided is true and accurate.

10. Gather any additional documentation required to support your application, such as proof of income, identification, or other relevant documents. Attach these documents to your completed form.

11. Double-check all the information provided before submitting the HRA 121 form. Make copies for your records, if needed.

12. Submit the completed form, along with any supporting documentation, according to the instructions provided by the relevant authority or agency. This may include mailing the form, submitting it in person, or applying online.

It's important to note that the specific instructions and requirements for filling out HRA 121 may vary depending on the jurisdiction and the specific benefits or assistance program. Therefore, it is advisable to review the instructions provided with the form or consult with the relevant authority or agency for any specific guidance.

What is the purpose of hra 121?

HRA 121 is a section of the Internal Revenue Code that pertains to the treatment of employer-provided housing. Its purpose is to outline the tax rules and regulations related to the fair market value of employer-provided lodging, known as a "parsonage allowance," for certain members of the clergy. HRA 121 specifies the conditions under which this housing benefit is excluded from taxable income, thus reducing the tax liability for qualifying religious leaders.

What information must be reported on hra 121?

HRA 121 is a specific form used by health reimbursement arrangements (HRA) to report various types of health insurance premium reimbursements. The information that must be reported on HRA 121 includes:

1. The employee's name, social security number, and address.

2. The employer's name, address, and identification number.

3. The premium reimbursement amount made by the HRA.

4. The date(s) of the premium reimbursement payments.

5. The type of health insurance coverage for which the premium was reimbursed.

6. If the HRA is integrated with a group health insurance plan, the information regarding the group health insurance coverage and the criteria for eligibility.

7. If the HRA funds are available for only eligible medical expenses, the specific types of expenses that are eligible for reimbursement.

8. Any other relevant information required by the IRS or the employer to accurately report the premium reimbursements made through the HRA.

It's important to note that the reporting requirements for HRAs may vary based on applicable tax regulations and guidelines. It's always recommended to consult with a tax professional or refer to the IRS instructions for the specific form to ensure accurate reporting.

How can I send hra 121 for eSignature?

Once your hra 121 fprm form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the hra broker request form electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your hra 121 form.

Can I edit hra brokers fee on an Android device?

You can make any changes to PDF files, like hra 121 e form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your hra 121 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hra Broker Request Form is not the form you're looking for?Search for another form here.

Keywords relevant to hra 121 e form

Related to hra brokers form 121e

If you believe that this page should be taken down, please follow our DMCA take down process

here

.